2019

There are two types of cell companies:

- The Protected Cell Company (PCC)

- The Incorporated Cell Company and its Incorporated Cells

These are similar to segregated account companies used in some other jurisdictions. It is a well recognised structure in international finance centres.

Protected Cell Companies

Legal Structure

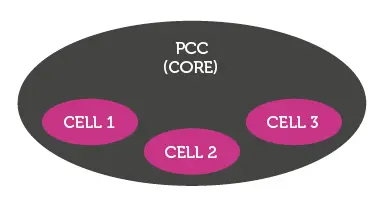

A PCC is a single legal entity with separate and distinct “cells” within it. Each cell may, but is not required to, have cell shares. A cell of a PCC cannot contract in its own name; it is the PCC which will be the contracting party, in respect of the relevant cell which must be identified.

There is no restriction to the number of cells which can be established by a PCC. A cell can be established by board resolution. There are no filing requirements in respect of the creation of new cells (unless the PCC is regulated).

A PCCs offers an efficient way for fund managers to launch multiple funds with minimal set up time whilst benefitting from significant economies of scale.

By establishing a new cell for each fund, the investor prospectus in respect of the PCC will remain the same, whilst engagements with managers, administrators and custodians can continue unchanged, with those agreements simply being extended to cover the new cell. The PCC will also benefit from the fund structure having already been reviewed and approved by the Commission, leading to a fast turnaround for regulatory authorisation for additional cells.

Presently there are over 100 PCCs operating in this way in Guernsey.

Regulation and uses

PCCs in Guernsey can be used for most regulated and unregulated businesses provided that they are administered by an entity licensed by the Guernsey Financial Services Commission.

PCCs are also popular as asset-holding vehicles and segregated investment vehicles for high net worth individuals.

Legal segregation & Position of Creditors

Assets and liabilities of cells in a PCC are, by law, segregated from those of other cells and those assets are not available to creditors of other cells in an insolvency. Recourse beyond the cell is permitted only in certain circumstances.

In every transaction entered into by a PCC in respect of a cell, there is an implied provision that no party shall seek, whether in any proceedings or by any other means whatsoever or wheresoever, to make or attempt to make liable any cellular assets attributable to any other cell of the PCC.

Dividends

A PCC may pay a cellular dividend in respect of cell shares by reference only to the cellular assets and liabilities, or the profits, attributable to the relevant cell. In determining whether or not profits are available for the purpose of paying a cellular dividend, no account need be taken of:

- the profits and losses, or the assets and liabilities, attributable to any other cell of the company; or

- non-cellular profits and losses, or assets and liabilities.

Directors’ Duties

A PCC has a single board of directors.

It is the duty of the directors of a PCC:

- to keep cellular assets separate and separately identifiable from non-cellular assets;

- to keep cellular assets attributable to each cell separate and separately identifiable from cellular assets attributable to other cells;

- where transacting in respect of a cell, inform third parties of this fact.

Uses of PCCs for investment funds