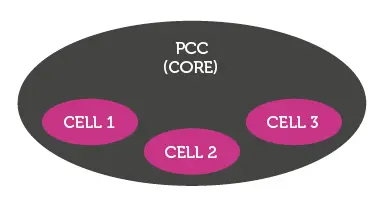

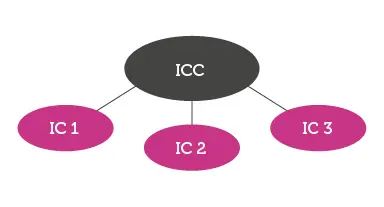

There are two types of cell companies:

- The Protected Cell Company

(PCC); and - The Incorporated Cell Company

(ICC) and its Incorporated Cells (ICs)

These are similar to segregated account companies used in some other jurisdictions. It is becoming a well recognised structure amongst international finance centres.

There are a few technical differences between cellular companies in Guernsey and Jersey but by and large they operate in similar ways.

Protected Cell Companies

Legal Structure

A PCC is a single legal entity with separate and distinct “cells” within it. Each cell may, but is not required to, have cell shares. A cell of a PCC cannot contract in its own name; it is the PCC which will be the contracting party, in respect of the relevant cell which must be identified.

The ICC and each of its ICs have the following in common:

- Secretary; and

- Registered office.

A Guernsey ICC and its ICs also have a common board of directors.

A single annual return or validation is filed for the ICC containing information relevant to each IC.

ICs contract in their own names as they are separate and distinct entities from their ICC.

Uses

They are subject to the same restrictions and enjoy the same flexibility as PCCs in the relevant jurisdiction. However, they are seen as particularly versatile structures for the following reasons:

- a lower cost base (compared to standalone companies) because of the ability to share management costs through the ICC, particularly attractive for fledgling ventures; and

- the ability to spin-off an IC or convert into a stand-alone company through various mechanisms set out in the legislation. There are other ways in which ICCs and ICs may be reorganised.

As with PCCs, they could be used for structuring investment holding companies.

An example of this would be property development and holding companies each set up within different ICs or cells to hold intellectual property rights or image rights of budding sports stars.

Legal segregation & Position of Creditors

Legal segregation is achieved by reason of the fact that an ICC and an IC are each distinct corporate entities. The position of creditors is the same as for a normal corporate entity. ICs contract in their own name hence there is no issue of cross liabilities within an ICC.

Uses

When the concept of PCCs was first introduced in Guernsey in 1997, only collective investment funds and insurers could be established as PCCs.

Today, PCCs in Guernsey can be used for most businesses provided that they are administered by an entity licensed by the Guernsey Financial Services Commission in Guernsey.

Although Jersey law does not seek to restrict the use of PCCs, the Jersey Financial Services Commission will monitor their uses and issue guidance if necessary.

Because a PCC is a single legal entity for tax purposes, it can be seen as a solution for entities caught by Controlled (Foreign) Companies rules of their jurisdiction.

Beyond the funds and captive/life insurance markets, they are popular as asset-holding vehicles and segregated investment vehicles for high net worth individuals.

Legal segregation & Position of Creditors

Assets and liabilities of cells in a PCC are, by law, segregated from those of other cells and those assets are not available to creditors of other cells in an insolvency. Recourse beyond the cell is permitted only in certain circumstances.

In every transaction entered into by a PCC in respect of a cell, there is an implied provision that no party shall seek, whether in any proceedings or by any other means whatsoever or wheresoever, to make or attempt to make liable any cellular assets attributable to any other cell of the PCC.

Dividends

A PCC may pay a cellular dividend in respect of cell shares by reference only to the cellular assets and liabilities, or the profits, attributable to the relevant cell. In determining whether or not profits are available for the purpose of paying a cellular dividend, no account need be taken of:

- the profits and losses, or the assets and liabilities, attributable to any other cell of the company; or

- non-cellular profits and losses, or assets and liabilities.

Directors’ Duties

It is the duty of the directors of a PCC:

- to keep cellular assets separate and separately identifiable from non-cellular assets;

- to keep cellular assets attributable to each cell separate and separately identifiable from cellular assets attributable to other cells;

- where transacting in respect of a cell, inform third parties of this fact (and in the case of a Jersey PCC, ensure it is reflected in the relevant minutes).

Incorporated Cell Companies and Incorporated Cells

Legal Structure

An ICC is a legal entity, as are each of the ICs associated with it.