Special purpose acquisition companies (affectionately known as SPACs) or cash shells have always been newsworthy in the City.

Earlier this month it was announced that the advisers involved (a well known bank along with two well-known international law firms) in the creation of London listed mining company, Bumi, had been censured by the UK Takeover Panel. (For a brief summary of Bumi's journey, see our earlier note on SPACs.) The events in question occurred five years ago. What they say about the wheels of justice turning very slowly seems to ring true.

In other news, SPACs continue to enjoy the unwanted attention of the London Stock Exchange (LSE) which regulates companies listed on the Alternative Investment Market (AIM). There are currently about 55 SPACs listed on AIM and 30 on the Main Market or ISDX (ICAP Securities and Derivatives Exchange). LSE appears to be rattled by recent high-profile fiascos (Chinese-backed Gate Ventures being one) and is trying to raise the bar for new entrants.

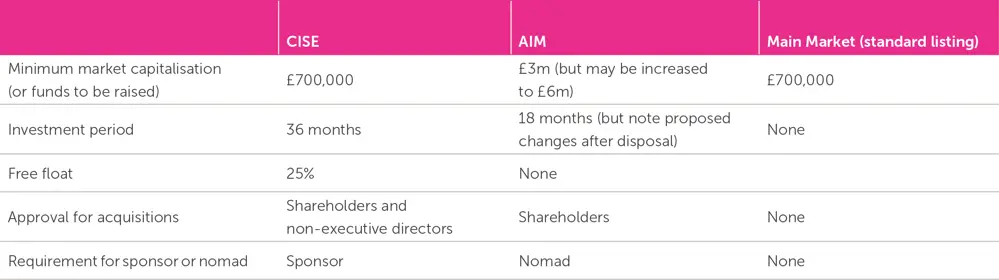

In October, LSE published a consultation notice setting out the following proposals for SPACs (referred to as "investing companies" in the AIM rules):

- The minimum to be raised will be increased to £6m (currently £3m).

- Companies that become cash shells after a fundamental disposal will have to either implement its investing policy or make an acquisition which constitutes a reverse takeover during a prescribed period. This prescribed period will be reduced to 6 months from the current 12 months.

The consultation period for these proposals ended on 12 November. If implemented these could act as further deterrents to potential entrants to AIM, which is already more expensive and inflexible than a standard listing on the Main Market.

Not wanting to be left behind in the SPAC race, the Channel Islands Securities Exchange (CISE) have announced the introduction of new rules for listing SPACs, effective from 23 November. CISE is clearly keen to emphasise its competitive terms and flexibility.

Sealand Capital Galaxy Limited – SPAC listing on London Stock Exchange

This firm recently acted as Cayman Islands legal counsel to Sealand Capital Galaxy Limited, assisting onshore London counsel (Fladgate LLP) with its standard listing on the London Stock Exchange. The company was established to make an acquisition in the social media sector and was admitted to trading on the LSE on 17 November 2015. Its management are based in Hong Kong and Singapore.

Unlike companies in Guernsey or Jersey, Cayman Islands companies are required to use a depositary to issue depositary interests to investors into CREST, as opposed to issuing shares directly to investors.

SPACs are relatively new in the Cayman Islands. However we see this as a potential growth area as the market develops.

CISE may wish to differentiate itself as a credible incubator platform preparing companies for life on LSE once they acquire greater substance

It will be interesting to see how well received the CISE will be as an alternative listing venue to the more established London markets. Given its scale and place in the pecking order, CISE may wish to differentiate itself as a credible incubator platform preparing companies for life on LSE once they acquire greater substance. In view of the likely direction of travel of AIM, this may be an opportune moment for CISE to step up.