INSOLVENCY REGIME

The BVI’s insolvency regime, both individual and corporate, is directed by the Insolvency Act 2003 (Act) and the Insolvency Rules 2005 (Rules). The provisions of the Act and the Rules are heavily based on the UK Insolvency Act 1986.

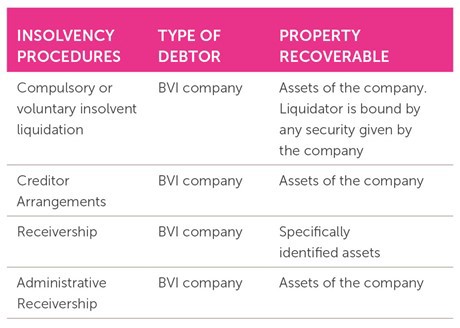

The table below summarises the regimes under the Act in very general terms:

The Act contains provision for administration, which are similar to the English regime and provide for a statutory moratorium to promote the salvage of companies, however these provisions are not yet in force.

COMPANIES LAW INSOLVENCY

The insolvency procedure is set out in the Act.

LIQUIDATION

A company can enter liquidation voluntarily or, as is more usual within the insolvency context, compulsorily pursuant to an order of the BVI Commercial Court (Court) if the company is regarded as being insolvent, the test for which is that:

- the company is unable to pay its debts as they fall due (cash flow insolvent);

- the value of the company’s liabilities exceeds its assets (balance sheet insolvent); or

- the company:

- fails to comply with a valid statutory demand (relating to an undisputed debt exceeding US$2,000 in value); or

- has a judgment (or other order of the Court) against it returned partly or wholly unsatisfied.

However there are other grounds, other than insolvency, upon which the Court may make a liquidation order. Notably, the Court can also order a company into liquidation where it is 'just and equitable' to do so or where (only on the application of the Attorney General or BVI Financial Services Commission (BVI FSC)) winding up the company would be in the public interest.

In a liquidation, an 'Eligible Insolvency Practitioner' is appointed as the liquidator. The practitioner must be either a BVI-licensed insolvency practitioner or an overseas practitioner (who is not licensed in the BVI) can take up the role where jointly appointed with a BVI-licensed insolvency practitioner.

The liquidator takes control of the company’s affairs and has all the necessary powers to wind it up in an orderly manner. Accordingly:

- any payments to creditors within a certain period of the start of the winding up can be clawed back as unlawful preference payments, in certain circumstances;

- the liquidator can take action against the directors as a result of breach of duty or other misfeasance to recover funds or property of the company;

- the liquidator is required to present a report to the Court once the assets of the company have been realised;

- when the assets of the company are distributed the company is then dissolved.

The Act sets out a priority in which the realised assets of the company should be distributed.

Firstly, the sale proceeds of charged assets are paid to the relevant secured creditors. Priority in respect of registered creditors is established by the date of the registration of the creditor’s charge with the Registry of Corporate Affairs in the BVI.

Secondly, in relation to the unsecured assets of the company, the following order is applied:

1. the costs associated with the liquidation and the expenses of the liquidator;

2. preferential creditors, being:

a. the BVI government (in respect of taxes and other charges, to a maximum of US$50,000);

b. the BVI FSC (in respect of any fees and penalties, to a maximum of US$20,000);

c. employees of the company (in respect of wages, social security and pension contributions, each capped at certain levels);

3. unsecured creditors.

On completion of the liquidation, a final report is prepared by the liquidator, circulated to the members and creditors of the company, and is filed with the Registrar of Corporate Affairs in the BVI. After completion of this step, the company is declared dissolved and struck off the register of companies.

In addition to being liable to an action to return property of the company, liquidation has other serious consequences for directors of the company. Directors of an insolvent company may be liable for wrongful trading where the company traded at a time the director was aware that the company was likely to be insolvent. They also risk having a disqualification order made against them barring them from future involvement in the management or affairs of other companies.

RECEIVERSHIP

The Act and the Rules provide for the appointment of receivers to reclaim sums owed in respect of certain assets of BVI companies either as the holders of a debenture or a floating charge (administrative receivership).

The practical process for receivership in the BVI broadly follows the process observed in the UK, with a few particular steps that must be observed. In the case of an administrative receivership, the receiver who is appointed must be a BVI-licensed insolvency practitioner. An ordinary receiver need not be licensed in the BVI to carry out his duties.

At completion of an ordinary receiver’s duties, they must prepare a report of receipts and payments for certain stages during the course of their appointment. In addition to this duty, administrative receivers must prepare and file a report of the sums owed to creditors during the first 3 months of their appointment.

CREDITOR'S ARRANGEMENTS

Similarly to the provisions for a company voluntary arrangement under the English regime, the Act and the Rules provide for a company to enter into a creditors’ arrangement (CA).

The proposal to enter into a CA can be made by the company’s directors, liquidator or administrator, as applicable. When the proposal is made, the company must either be insolvent or insolvency must be likely. If a CA is pursued, there is no moratorium on the rights of creditors, the rights of secured of preferential creditors cannot be affected (without consent) and there is no need for Court involvement.

Within the document setting out the terms of the CA, a BVI-licensed insolvency practitioner must be appointed and named to oversee the process in a capacity as an interim supervisor. The appointed interim supervisor will then call a meeting of the creditors, where the CA will be considered. All of the main terms and supervisor’s powers are set out in the CA itself.

To be adopted and become binding, 75 per cent (by value) of the company’s creditors must agree to the terms of the CA. Once adopted the CA is binding on all of the company’s creditors, whether they attended the meeting or not.

LOCATION OF ASSETS

This note describes proceedings relating to assets located in the BVI. If the debtor’s assets are located outside the BVI, the ability of BVI insolvency procedures to access those assets will depend on the jurisdiction where the assets are based.

The Act contains provision for orders, which are related to insolvency proceedings which occur in certain locations, to be made in the BVI. The Court has powers in respect of the relevant entity’s BVI assets.

In making such an order, the Court must take the interests of any BVI creditors into account, in particular any BVI based secured creditors.