Businesses across the globe are facing an unprecedented cash flow crisis given the extraordinary measures governments are imposing to combat the Covid 19 pandemic. Jersey is uniquely placed to assist English listed public companies (plcs) to raise cash in a quick and efficient manner using a tried and tested method; the cash box placing.

The Pre-Emption Group (PEG) of the UK's Financial Reporting Council has recognised the immediate financial difficulties plcs are currently facing and, on 1 April 2020, recommended that until 30 September 2020, shareholders consider, on a case by case basis, supporting non-pre-emptive share issues of up to 20% of a plc's issued ordinary share capital. The PEG's Statement of Principles on Disapplying Pre-Emption Rights issued in 2015 only supports non-pre-emptive share issues of up to 5% issued ordinary share capital.

As a result of the PEG's recommendation, a cash box placing will be a more attractive option to plcs that urgently need to raise cash to fund their businesses. In particular, a cash box placing will be a much quicker and cheaper way to raise funds than a traditional placing, rights issue or debt financing in an uncertain and volatile market.

What is a cash box placing?

A cash box placing is a transaction that allows a plc to quickly raise funds from institutional investors. It involves issuing shares without needing to comply with the pre-emption rights that apply under the UK Companies Act 2006.

Why is it quicker than a rights issue or traditional placing?

A cash box takes advantage of an exemption under the UK Companies Act 2006 that allows a plc to issue shares without the need to adhere to statutory pre-emption rights, provided that only non-cash consideration is received by the plc.

A cash box placing that involves the issue of not more than 20% of a plc's issued share capital will not require the plc to produce a prospectus under the EU Prospectus Regulation.

Depending on the plc's articles of association and shareholder approvals already in place, it may be possible to raise funds through a cashbox placing without requiring shareholder approval and the time and expense of holding an EGM.

How does it work?

The payment of non-cash consideration is achieved because investors do not subscribe for shares directly in the plc.

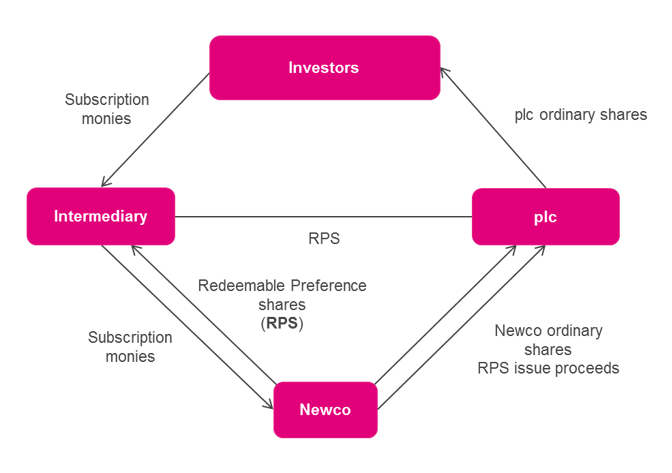

Rather, the process is as follows.

- The plc incorporates and subscribes for ordinary shares in a new Jersey company (Newco).

- A dealer or underwriter (Intermediary) will solicit subscriptions from investors for redeemable preference shares (RPS) in Newco.

- The Intermediary will subscribe and pay for RPS on behalf of the investors for an aggregate cash price equal to the net cash amount the plc would like to raise.

- The Intermediary agrees to transfer the RPS to the plc in exchange for the plc issuing new ordinary shares directly to the investors nominated by the Intermediary.

- The plc's newly issued ordinary shares will be admitted to trading on the relevant securities exchange (typically, the London Stock Exchange).

As a result of these steps:

- the plc will have issued shares for a non-cash consideration (the transfer to it of the RPS);

- Newco will be wholly owned by the plc; and

- Newco will be holding the RPS issue proceeds raised from the investors.

Newco will then pay the RPS issue proceeds to the plc by:

- redeeming the RPS held by the plc;

- lending the RPS issue proceeds to the plc; or

- distributing the RPS issue proceeds to the plc as part of Newco's solvent winding up.

The best option will depend (among other things) on the plc's UK tax advice.

Once the cashbox placing has been completed, Newco will be wound up.

The cashbox placing process is shown in the diagram below.

Tax

Newco is typically UK tax resident, and therefore managed and controlled in the UK, which means that HM Treasury consent is not required in relation to the issue and transfer of Newco shares.

There will be no Jersey tax in relation to capital gains, income, corporation tax, VAT or withholding tax in relation to the issue, transfer or redemption of shares, or the making of distributions to the plc.

No UK stamp duty is payable on the transfer of Newco's shares from the Bank to the plc as a result of Newco's register of members being held in Jersey.

Benefits of a Jersey company

There are advantages of using a Jersey company for a cash box placing, including the following:

- A Jersey company can redeem shares from any source, including share capital, on the passing of a 12-month look-forward solvency statement.

- A Jersey company can be wound up quickly, easily and with minimal cost without the need to appoint a liquidator.

- A Jersey company that is managed and controlled in the UK is out of scope of the Jersey economic substance law, and does not need to hold board or shareholder meetings in Jersey, or have Jersey resident directors.

- Jersey companies law is similar to English companies law, but more flexible, in relation to things like redeeming shares, making distributions and the contents of a company's memorandum and articles of association.

- Jersey is in the same time-zone as the UK.

- A Jersey company can be incorporated quickly, within two hours on payment of a fast-track fee.

- There will be no stamp duty payable on the transfer of shares, which will be made on the register of members in Jersey.

Alternative structures

There are various alternatives and additional features to the structure described above.

If the plc wishes to create distributable reserves using the merger relief provisions of the UK Companies Act 2006, each of the Intermediary and the plc will subscribe for ordinary shares in Newco. Newco ordinary shares held by the Intermediary will be transferred to the plc at the same time as the preference shares.

Another common structure is for Newco to issue bonds to investors that are convertible into RPS in Newco. Upon conversion of the bonds into RPS, they are immediately transferred to the plc, in exchange for the plc issuing new ordinary shares to the investors.

In this case, from a Jersey law perspective and depending on the number of bondholders, an additional consent may be needed from the Jersey Financial Services Commission, and Newco may need to be incorporated as a public company rather than a private company.

Bonds are often listed to qualify for the Quoted Eurobond Exemption from UK withholding tax on interest payments. If so, The International Stock Exchange (TISE) is designated by HMRC as a recognised exchange and is frequently used for the listing of debt, including convertible bonds. Collas Crill are able to assist with all aspects of a listing on TISE with our in-house listing agent business, Collas Crill Listings Ltd.

How can we help

Collas Crill's corporate, finance & funds team has many years of experience in dealing with international fund raising matters including cash box structures, and are here to help our listed clients in these difficult times.

About Collas Crill

We are a leading offshore law firm. We are easy to do business with and give practical advice to overcome tough challenges. Through our network of offices, we practise British Virgin Islands, Cayman Islands, Guernsey and Jersey law.