INSOLVENCY REGIME

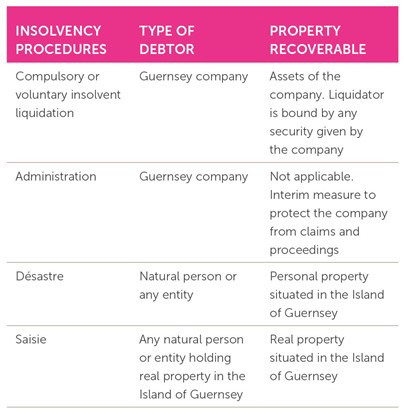

The Guernsey insolvency regime can usefully be categorised by drawing a distinction between:

• the traditional procedures of désastre and saisie; and

• the more modern corporate insolvency procedures, as provided for in the companies legislation.

The table below summarises the differences in very general terms:

COMPANIES LAW INSOLVENCY

These are set out in the Companies (Guernsey) Law, 2008 (as amended) (Companies Law). In many respects, the Guernsey provisions are similar to the corporate insolvency regime in the UK.

LIQUIDATION

A company can enter liquidation voluntarily or, as is more usual within the insolvency context, compulsorily pursuant to an order of the Royal Court of Guernsey (Court) if the company is “unable to pay its debts”, the test for which is that:

• a creditor has served a written demand for payment on the company for a sum exceeding £750 and the company fails to pay within 21 days; or

• it is proved to the satisfaction of the Court that the company fails to satisfy the “solvency test”.

Solvency Test

This is the test as to whether the company:

• is able to pay its debts as and when they fall due (cash flow test); and

• has more assets than liabilities (balance sheet test); and

• if it is regulated by the GFSC, complies with all its regulatory financial adequacy requirements.

However there are a number of grounds, other than insolvency, upon which the Court may make a liquidation order. Generally these relate to various failures of the company to properly function in accordance with company law requirements. Notably, the Court can also order a company into liquidation where it is “just and equitable” to do so or where (only on the application of the Guernsey Financial Services Commission (GFSC)) winding up the company would be in the best interest of the public or to uphold the reputation of the Bailiwick of Guernsey.

In a liquidation, an independent person, the liquidator, takes control of the company’s affairs and has all the necessary powers to wind it up in an orderly manner. Accordingly:

• any payments to creditors within a certain period of the start of the winding up can be clawed back as unlawful preference payments, in certain circumstances;

• the liquidator can take action against the directors as a result of breach of duty or other misfeasance to recover funds or property of the company;

• the liquidator is required to present a report to the Court once the assets of the company have been realised. A Commissioner will be appointed to examine his accounts and make any appropriate distributions to creditors, subject to certain priority claims being recognised;

• when the assets of the company are distributed the company is then dissolved.

In addition to being liable to an action to return property of the company, liquidation has other serious consequences for directors of the company. Directors of an insolvent company may be liable for wrongful trading where the company traded at a time the director was aware that the company was likely to be insolvent. They also risk having a disqualification order made against them barring them from future involvement in the management or affairs of other companies.

ADMINISTRATION

The purpose of an administration is to create a temporary ‘safe haven’ for a company in financial difficulties.

An application for administration may be made to the Court by:

• the company;

• the directors of the company;

• any member;

• any creditor; or

• the GFSC in the case of a regulated company.

The grounds for making an administration order are that:

• the company does not satisfy the “solvency test”; and

• an administration serves a “purpose” that is, it may:

• increase the prospects of survival of the company or any part of it as a going concern; or

• achieve a better result for the company and its creditors than a liquidation of the company.

The Court will only grant an administration order for a specified period of time, and any extension will be subject to being satisfied that its purpose may still be achievable.

The administrator has wide powers to operate the company’s businesses. During the administration Court proceedings cannot be commenced or continued against the Company without the leave of the Court (or the consent of the administrator), except for claims of secured creditors.

The key advantage of the administration process is its flexibility. There are no formal rules or requirements for reporting, and the general procedures for handling claims and distributing assets that apply in liquidation do not necessarily have to be followed.

Protected cell companies

A cell of a protected cell company is not a separate legal entity in its own right. Accordingly a cell cannot be subject to a liquidation. It may however have a receivership order (akin to a liquidation) or an administration order made against it on broadly the same grounds and in the same terms as those affecting a company.

DÉSASTRE

In a désastre, the arresting creditor first applies to the Court for an order that the judgment be executed against the debtor’s personal property. HM Sheriff will investigate the debtor’s assets, arrest those assets up to the value of the arresting creditor’s debt and with the permission of the Court sell the assets by public auction. If it transpires that there are other debts which are likely to exceed the proceeds of sale, this will trigger the commencement of a désastre.

The désastre process involves the appointment of a Commissioner to convene a meeting of creditors during which claims against the debtor will be marshalled. The proceeds are distributed in a set order.

Désastre does not extinguish creditors’ claims against the debtor to the extent that those claims remain unpaid. Subject to any limitation periods a creditor could claim in a subsequent désastre should further personal property be discovered, or initiate a saisie in respect of the debtor’s real estate, for any unpaid amounts.

SAISIE

Saisie entails a process of realisation and distribution of the debtor’s real property which is conceptually similar to a désastre. After obtaining judgment against the debtor, an arresting creditor electing saisie will:

• obtain a preliminary vesting order (PVO) over the debtor’s real property. A PVO does not give title over the debtor’s real property to the arresting creditor, but allows the creditor to exercise certain powers in relation to the property including the power to evict or collect rent from tenants. This order can be sought either as part of the initial judgment for the debt or at some later time;

• obtain an interim vesting order (IVO) which effectively transfers the debtor’s property to the arresting creditor who will hold it (and any rents or profits derived from it) on trust for all potential claimants against that property;

• after obtaining an IVO, call for claims against the debtor’s property. The register of claims is maintained by the Greffe (the Court Registry in Guernsey).

A Commissioner will marshal the claimants to prove their debts before him. Finally, the Commissioner will request the Court to make a final vesting order (FVO). During this hearing the Court will ask each creditor in turn, starting with those having the lowest priority claims, whether they wish to either:

• take the real property of the debtor, on condition that they discharge all higher priority claims in full; or

• renounce their claim against the debtor.

Critically, once the creditor commences or participates in a saisie, he irrevocably waives his rights to pursue the debtor’s personal property. Unlike désastre, the debt is extinguished and no future claims against the debtor (including a désastre) can be made in respect of the debt.

Unlike a corporate insolvency which may lead to sanctions against the directors, a debtor in a désastre or saisie suffers no formal punitive consequences or adverse impact on his professional status.

LOCATION OF ASSETS

This note describes proceedings relating to assets located in Guernsey. If the debtor’s assets are located outside Guernsey, the ability of Guernsey insolvency procedures to access those assets will depend on the jurisdiction where the assets are based.

There are no bankruptcy treaties in force between Guernsey and any other territory. However, by virtue of the Insolvency Act 1986 (Guernsey) Order 1989 (Insolvency Act Order), the courts of the Bailiwick of Guernsey will assist courts having jurisdiction in relation to insolvency law in any other part of the Bailiwick of Guernsey or any relevant country or territory. A “relevant country or territory” means the United Kingdom, Bailiwick of Jersey and the Isle of Man.

The effect of the Insolvency Act Order is that, if an English court makes any order under the UK Insolvency Act 1986 with regard to any assets outside England, those orders are enforceable in Guernsey, Sark and Alderney, subject to the local laws and practices of the jurisdiction concerned.